Post by : Amit

The Silent Force Behind the Wheel

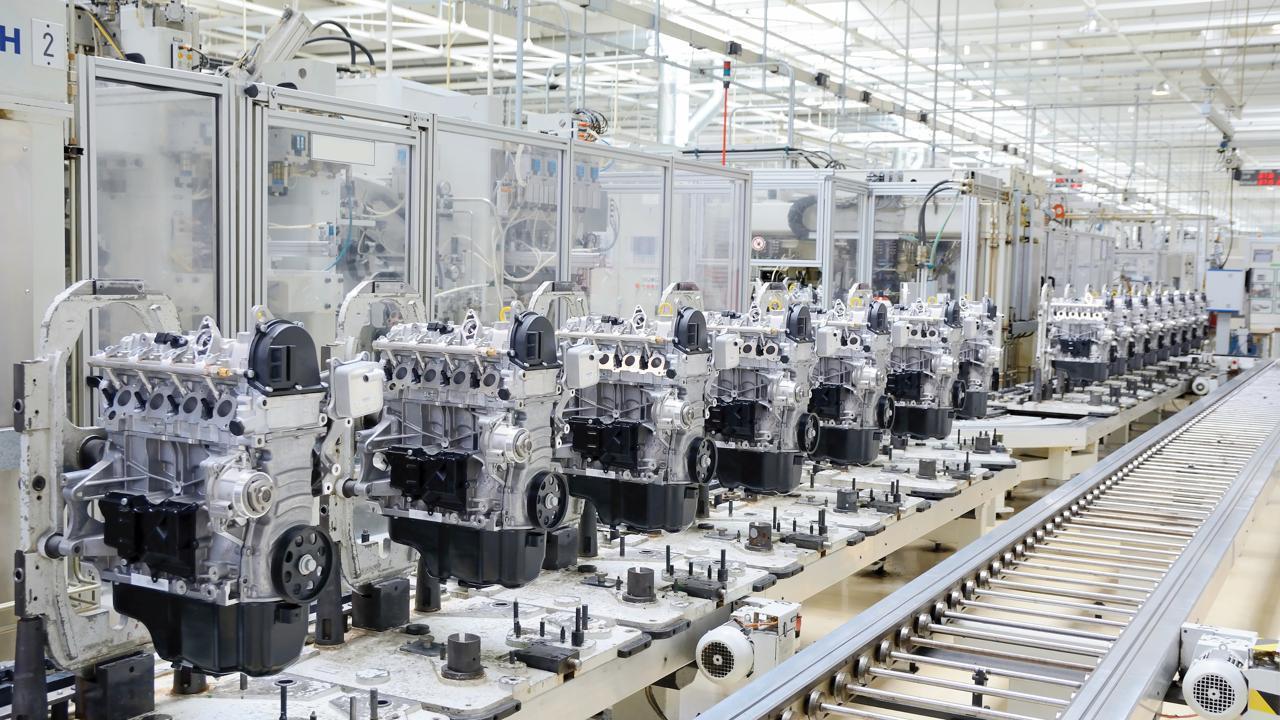

When most people think of the global auto industry, they picture sleek German sedans, American trucks, or cutting-edge Japanese hybrids. But peel back the outer skin of nearly any modern vehicle—electric or fuel-powered—and you’ll find a quiet but powerful influence: Chinese car components.

From semiconductors and sensors to seats, batteries, and brake systems, China’s sprawling automotive parts industry has become the backbone of global vehicle manufacturing. It’s no longer just the factory floor of the world—it’s becoming its engineering lab, R&D hub, and strategic stronghold.

And in 2025, this influence is being felt more acutely than ever.

A Trillion-Dollar Engine

China is now the world’s largest producer and exporter of automotive components. As of 2024, the sector’s value surpassed USD 550 billion, with projections pointing toward a USD 1 trillion industry by 2030. China exports components to over 200 countries, serving major automakers like Volkswagen, Tesla, Toyota, Ford, Hyundai, and even premium EV startups like Rivian and NIO.

Recent reports from China Association of Automobile Manufacturers (CAAM) highlight that in Q2 2025 alone, exports of automotive components rose by 18.7%, bolstered by rising demand in Europe, Southeast Asia, and South America. EV-related parts such as battery cells, BMS modules, wiring harnesses, and electric motors now account for more than 32% of total component exports.

Supply Chain Mastery Meets Scale

China’s auto components ecosystem operates on a level few countries can replicate. It includes thousands of Tier 1, Tier 2, and Tier 3 suppliers integrated into vertically connected clusters. In Guangdong, Chongqing, Zhejiang, and Jiangsu provinces, entire industrial zones are dedicated to specific parts—be it casting, electronics, drivetrain modules, or interior systems.

This dense, agile supply chain reduces lead times, lowers logistics costs, and fosters real-time collaboration between OEMs and suppliers. When BYD or Geely decides to introduce a new vehicle line, their component suppliers can often respond with production-ready modules in under 90 days—a speed unmatched in North America or Europe.

The geographical scale is staggering: the city of Liuzhou alone houses over 500 automotive parts manufacturers; Ningbo, in Zhejiang, is home to more than 1,200.

Electric Vehicles: A Catalyst for Innovation

The rise of EVs has given Chinese parts manufacturers a new growth engine. Local suppliers, once considered good only for low-margin, low-tech parts, are now producing advanced power electronics, silicon carbide inverters, ADAS systems, and even AI-powered battery management units.

CATL and BYD dominate the global EV battery market, but beneath them are hundreds of parts vendors like Gotion High-Tech, Farasis Energy, and SVOLT that are innovating rapidly.

Meanwhile, China's focus on smart, connected cars has boosted production of lidar units, infotainment modules, vehicle control ECUs, and thermal management systems. Companies like Desay SV, Joyson Electronics, and Neusoft Reach are becoming global suppliers of digital cockpit components and intelligent hardware.

Tesla’s Gigafactory in Shanghai sources more than 70% of its components locally. Even luxury automakers like BMW now rely on Chinese firms for their in-car electronics and digital dashboards.

What’s Driving Global Demand for Chinese Parts?

Several factors are pushing global automakers to deepen ties with Chinese parts suppliers:

1. Cost Efficiency with Quality:

Chinese manufacturers offer competitive pricing without compromising on quality. With ISO certifications, Six Sigma systems, and state-backed testing labs, quality standards have improved dramatically over the past decade.

2. Unmatched Production Capacity:

Whether it's 10,000 units or 10 million, Chinese factories can scale up or down quickly. This flexibility is critical as global automakers shift platforms or respond to demand surges.

3. R&D at the Speed of Software:

China’s parts makers are moving away from build-to-print toward build-to-innovate. Many now have in-house design teams, simulation labs, and collaborations with universities. For instance, Nobo Auto Tech has launched 3D-printed chassis modules and smart HVAC units.

4. Government Policy and Subsidies:

China’s industrial policy heavily supports the auto components sector, particularly for green mobility and export-driven units. Tax incentives, land grants, and R&D credits have lowered costs across the board.

5. Reliability During Crises:

During the COVID-19 pandemic and the 2021–22 chip shortage, many Chinese component suppliers proved to be more resilient than Western counterparts, maintaining stable supply to OEMs worldwide.

Barriers to Overcome

Despite its strengths, China’s car components sector faces mounting scrutiny and emerging challenges.

1. Geopolitical Tensions:

Trade restrictions, anti-dumping investigations, and growing protectionism in the EU and U.S. pose risks. Several Chinese suppliers face import barriers or are being forced to localize production in Europe or Mexico.

2. Intellectual Property (IP) Concerns:

Foreign OEMs continue to tread cautiously regarding IP protection. While China has made legal strides, some Tier 1s are reluctant to share core designs with local partners.

3. ESG Pressures:

Global buyers now demand transparent carbon footprints, ethical sourcing, and safe labor practices. Many Chinese suppliers are racing to meet these new procurement standards.

4. Rising Wages and Input Costs:

Though still competitive, the cost advantage is narrowing. Regions like Vietnam and India are emerging as low-cost alternatives, especially for basic mechanical components.

5. Overcapacity Risks:

In certain segments, particularly EV battery modules and infotainment systems, overproduction looms. This could lead to price wars and consolidation over the next five years.

Strategic Shifts and Global Partnerships

To mitigate risk and ensure market access, Chinese component firms are setting up manufacturing bases abroad. For instance:

Simultaneously, Western Tier 1s are partnering with Chinese firms to co-develop products. German companies like Bosch and Continental have joint development agreements with Chinese partners for radar modules, brake-by-wire systems, and smart cockpit platforms.

Such partnerships blend European engineering with Chinese speed-to-market—a potent formula in an era of rapid mobility transformation.

Globalization, Green Tech, and Giga-Factories

China’s car components sector will not merely survive—it will evolve and lead. Three big trends define the future:

1. Green Manufacturing:

Expect more solar-powered factories, closed-loop material systems, and carbon-neutral production lines. China is investing heavily in ESG compliance and recycling technologies, especially for EV batteries and composite parts.

2. Software-Defined Components:

From embedded systems to vehicle OS modules, parts will increasingly come with software preloaded. Chinese suppliers are already embedding edge AI and over-the-air (OTA) capabilities into sensors and ECUs.

3. Mega Platforms and Global Standardization:

As modular vehicle platforms grow, so does demand for standardized, scalable parts. Chinese suppliers that can deliver globally homologated, modular components will dominate Tier 1 contracts.

China’s Shift from Supplier to Shaper

China’s automotive components industry is no longer playing catch-up. It’s setting benchmarks—on cost, scalability, innovation, and speed.

For global OEMs, sourcing from China is no longer about saving money—it’s about staying competitive. Whether it’s for lightweight EV battery enclosures, next-gen brake systems, or lidar-powered safety modules, the world’s roads are increasingly built on Chinese foundations.

As the world drives toward a more electric, autonomous, and connected future, one thing is clear: the parts powering that future will increasingly come from China—not as copycats, but as creators.

China, Car Component, Global Mobility

Advances in Aerospace Technology and Commercial Aviation Recovery

Insights into breakthrough aerospace technologies and commercial aviation’s recovery amid 2025 chall

Defense Modernization and Strategic Spending Trends

Explore key trends in global defense modernization and strategic military spending shaping 2025 secu

Tens of Thousands Protest in Serbia on Anniversary of Deadly Roof Collapse

Tens of thousands in Novi Sad mark a year since a deadly station roof collapse that killed 16, prote

Canada PM Carney Apologizes to Trump Over Controversial Reagan Anti-Tariff Ad

Canadian PM Mark Carney apologized to President Trump over an Ontario anti-tariff ad quoting Reagan,

The ad that stirred a hornets nest, and made Canadian PM Carney say sorry to Trump

Canadian PM Mark Carney apologizes to US President Trump after a tariff-related ad causes diplomatic

Bengaluru-Mumbai Superfast Train Approved After 30-Year Wait

Railways approves new superfast train connecting Bengaluru and Mumbai, ending a 30-year demand, easi