Post by : Avinab Raana

Baweja Automotives is stepping up its game in India’s logistics sector by expanding its warehousing and transportation footprint across multiple states. The company, known for its component manufacturing, is investing heavily in storage infrastructure and logistics capabilities. This expansion isn’t just about bigger warehouses: it’s about faster deliveries, better inventory management, and tighter integration with suppliers and customers to meet growing demand in the automotive markets.

Automotive manufacturers and component suppliers often struggle with inventory bottlenecks. Baweja’s expansion aims to address these by setting up or expanding warehousing facilities in key industrial hubs. These new or upgraded warehouses promise improved storage standards, quicker turnaround for inbound and outbound shipments, and better space utilization. With e-commerce and aftermarket demands rising, these facilities will play a crucial role in making sure parts are available when needed.

Warehouse infrastructure is only one half of the equation. Baweja is simultaneously bolstering its logistics network adding more fleet vehicles, optimizing routes between plants, warehouses, and dealers, and integrating technology for real-time tracking. The goal is to reduce lead times and cost per kilometer, while improving predictability. For automotive supply chains, where delays can ripple through production lines, this kind of improvement can mean reduced downtime and smoother operations.

The expansion isn’t uniform; Baweja is prioritizing states with strong automotive clusters, good road and rail infrastructure, and rising demand for mobility. Locations near major OEM plants are getting special attention, as well as urban areas where aftermarket demand for spare parts, service, and repair is growing. The regional hubs will allow Baweja to serve both national clients and smaller local workshops with improved efficiency.

Baweja isn’t just building more space or buying more trucks. A critical piece of the project is the integration of tech systems for warehouse management (WMS), transportation management (TMS), and demand forecasting. These systems will allow the company to anticipate parts demand, avoid overstocking or stockouts, and reduce wastage. Real-time monitoring of shipments and smart tracking of inventory are intended to give Baweja a competitive edge in responsiveness and operational transparency.

With expanded warehousing comes potential for economies of scale: better rates with contractors, lower per-unit storage costs, and more efficient handling. Quality is also expected to improve, since better warehousing can reduce damage or loss. Speed of fulfillment will increase, especially for spare parts and aftermarket delivery. For customers, that means fewer delays, more reliable supplies, and better service levels all of this can enhance Baweja’s reputation in a very competitive industry.

Scaling operations isn’t without its hurdles. Finding appropriate land parcels in industrial zones, ensuring power and utility support, managing labor forces, and handling regulatory approvals are all time-consuming. There can also be hidden costs in infrastructure, maintenance, and security. Furthermore, demand forecasting must be accurate overbuilding what’s not needed can tie up capital inefficiency. Baweja will need to balance optimism with realism as it rolls out these plans.

Baweja’s move reflects a broader pattern in India where automotive and component manufacturers are investing heavily in logistics and warehousing. Rising vehicle sales, supply chain disruptions, rising fuel costs, and increasing consumer expectations for spare part availability are pushing firms to bring logistics back in-house or closely partner with warehousing operators. Baweja’s expansion signals confidence in India’s mobility market, and may encourage both smaller firms and peers to upgrade their logistics infrastructure.

The next few months will reveal whether Baweja’s expansion delivers on its promise. Key indicators will include how quickly new warehouses become operational, improvements in delivery lead times, inventory turnover rates, and the cost savings achieved. Also, customer feedback, especially from dealers and repair shops, will matter: do they see improved part availability? Finally, macro factors like fuel prices, road quality, regulation, and economic demand will influence how smoothly the expansion proceeds.

Baweja Automotives’ pan-India push into logistics and warehousing is more than a corporate growth plan. It’s a response to the evolving demands of India’s automotive sector, where efficiency, speed, and reliability are no longer optional. If Baweja navigates execution well and aligns its investments with customer needs, the expansion could set a benchmark. But success will rest not just on scale, but on coherence: the alignment between logistics, technology, and demand. India’s roads may be long and complex, yet for Baweja, they could become the path to supply chain leadership.

#Baweja Automotives expansion, #Logistics and warehousing India, #Automotive logistics growth

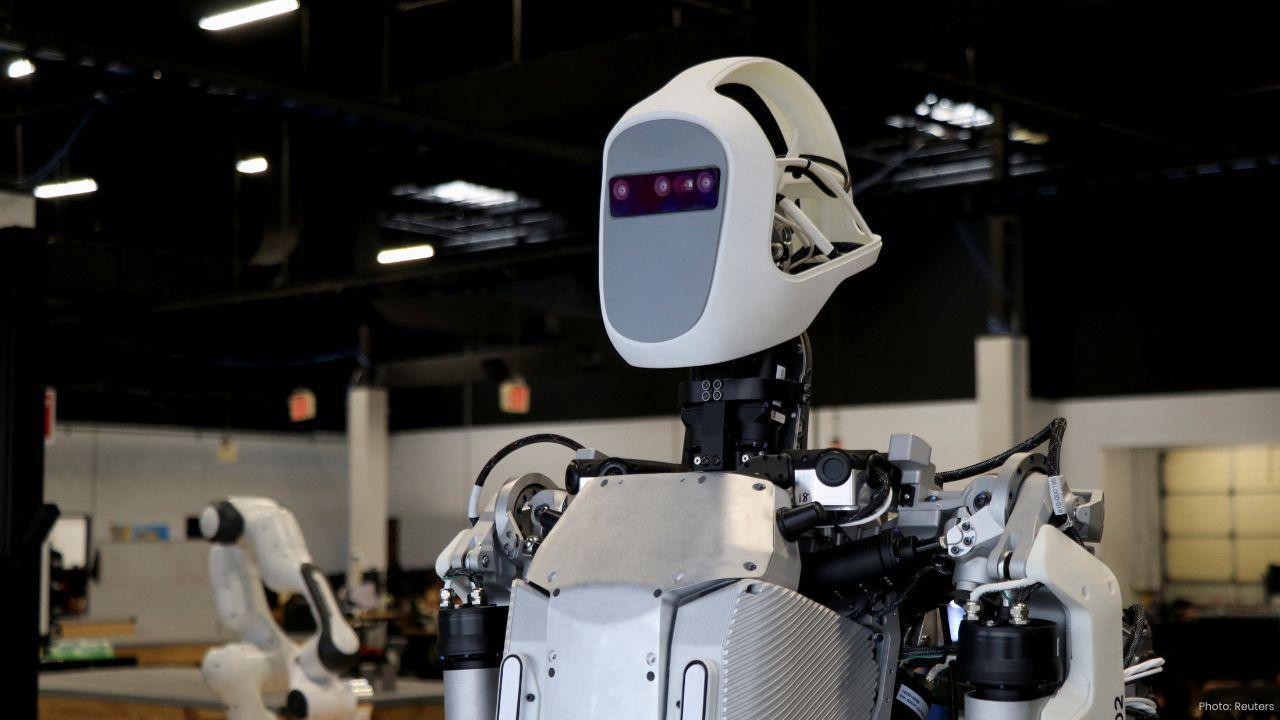

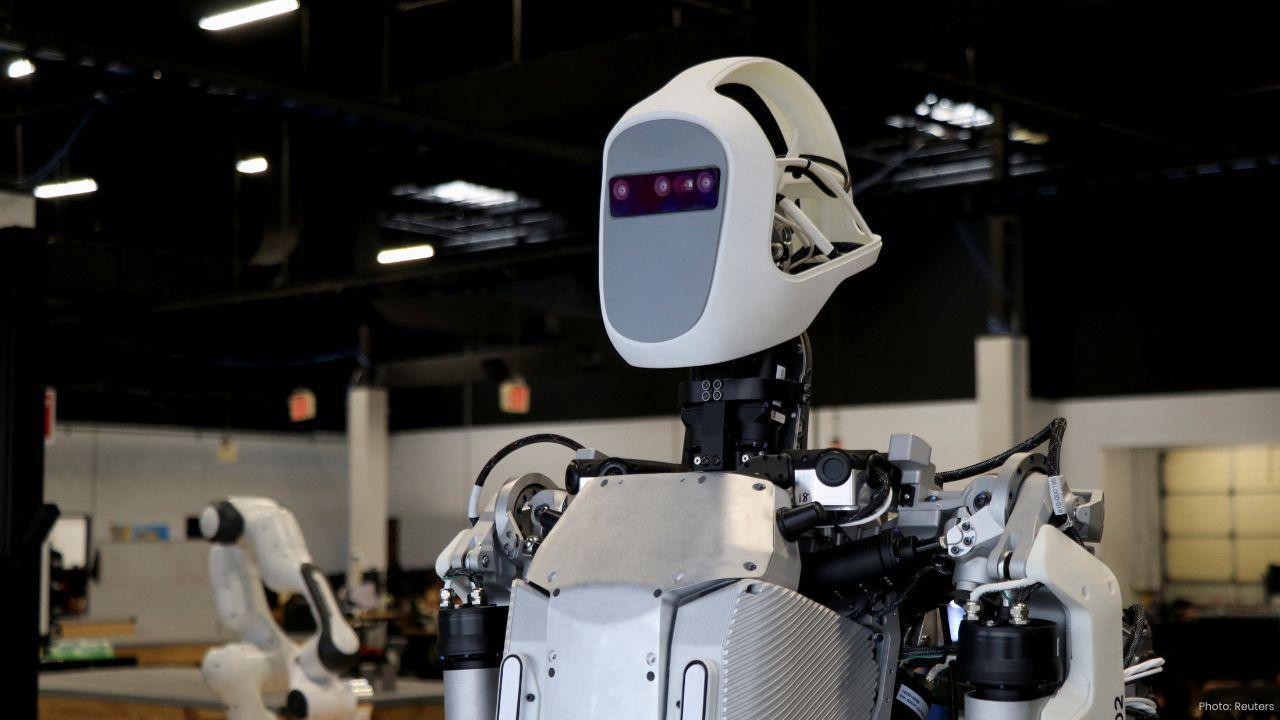

Unitree G1 Robot Shows Strong Agility and Recovery in Combat Test

Unitree’s G1 humanoid robot impresses with fast recovery, smooth movements, and strong agility durin

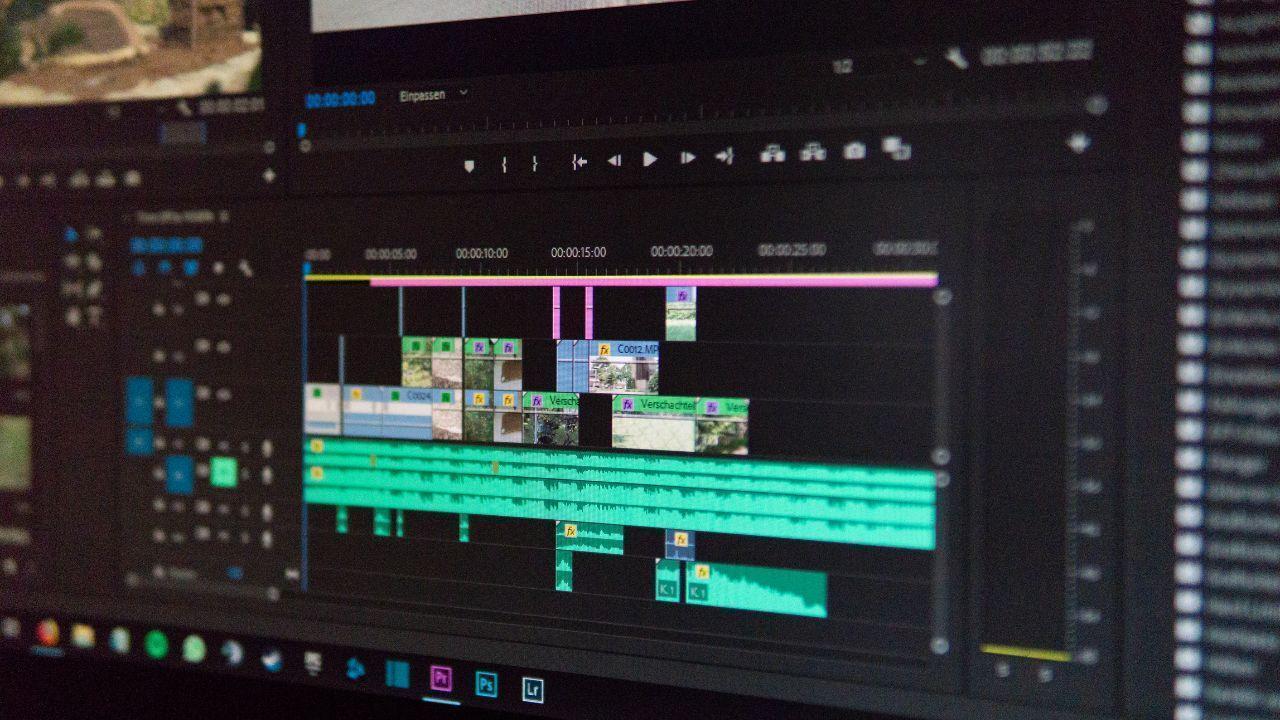

Autodesk Enhances Design & Production with AI-Powered Tools

Autodesk introduces advanced AI tools to streamline design and manufacturing, boosting efficiency an

2025 Mahindra Bolero Neo Facelift Spied With Fresh Grille Design

Spy photos reveal Mahindra’s forthcoming Bolero Neo facelift, showcasing a new front grille LED DRLs

Tata Technologies Acquires Germany’s ES-Tec Group for ₹750 Crore

Tata Technologies acquires Germany's ES-Tec Group for ₹750 crore to boost European operations and en

Harnessing Carbon Capture Balancing Industry and Climate Action

Carbon capture helps industries reduce emissions while growing, supporting sustainable development a

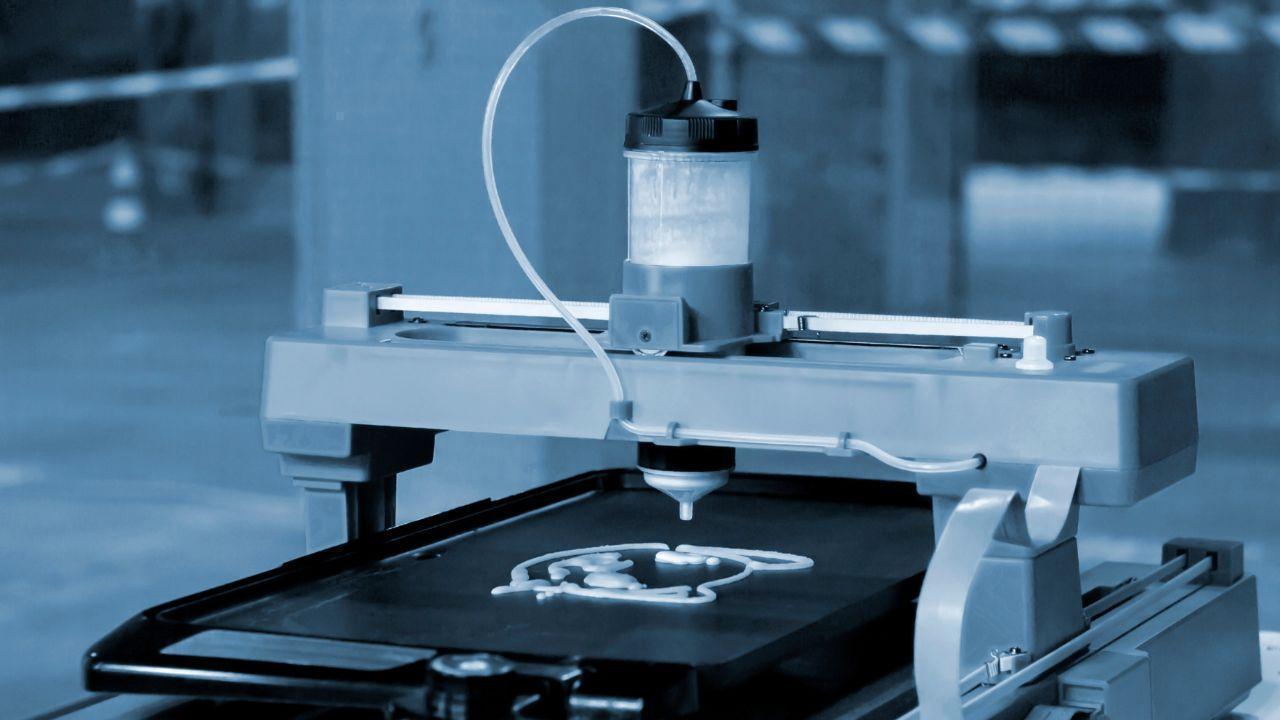

Meltio Opens First U.S. Metal 3D Printing Center in Danville

Meltio launches its first U.S. advanced metal 3D printing center in Danville, Virginia, featuring cu