Post by : Avinab Raana

Dhillon Freight Carrier Ltd has secured the crucial in-principle approval from BSE to list its shares on the SME platform under a fixed-price IPO of ₹10.08 crore. This clearance clears a major regulatory hurdle, paving the way for the company to access public markets and tap retail and institutional investors. Enthusiasts in logistics and capital markets are watching closely, as the IPO could open new dimensions for smaller players in India’s transport sector.

The IPO will issue 14,00,000 fresh shares, each priced at ₹72 per share, making the issue size one of moderate scale among SME-market offerings. Investors will need to commit a minimum of one lot, consisting of 1600 shares, translating into an investment of about ₹1,15,200. The shares proposed for listing are to be traded on the BSE SME platform. The lead manager for this issue is Finshore Management Services Limited, which will also handle required documentation and regulatory compliance.

Getting an in-principle nod from BSE SME is significant. This SME (Small and Medium Enterprises) platform provides easier access to equity funding with less stringent reporting and lower listing fees compared to main exchanges. For Dhillon Freight Carrier, this means faster market entry, better visibility among investors, and a chance to generate capital to scale its operations. In current conditions, where market liquidity for SME IPOs has been choppy, approvals like this create confidence among potential subscribers.

As a logistics player, Dhillon Freight Carrier operates in a sector that is benefiting from rising goods movement, e-commerce growth, and manufacturing supply chain investments. The company’s strategy includes scaling up warehousing, fleet deployment, and leveraging its geographical access. However, risks remain. Operational costs, fuel price volatility, competition from larger logistics firms, and ability to maintain efficiency at scale are all under investor scrutiny. The IPO will be evaluated both on the promise of growth and on the robustness of Dhillon Freight Carrier’s execution capability.

The offer size of ₹10.08 crore, while modest, reflects a valuation approach typical of SME issues. At ₹72 per share, the company’s valuation is tied closely to recent profit performance and projected growth. Unlike larger IPOs, Dhillon Freight Carrier may not command high multiples without demonstrating steady profit growth, firm order book, efficient asset usage, and strong cash flow. Analysts will look into its revenue, margin trends, and asset turnover to decide whether the IPO price is justified.

For investors considering Dhillon Freight Carrier IPO, the appeal lies in exposure to the logistics sector through a smaller growth-oriented company. Many retail and regional investors seeking SME IPOs have shown appetite, especially when offerings are clearly priced and well-marketed. The minimum investment amount is relatively high for some retail investors, which could limit full participation. Marketing and transparency will be key; Dhillon Freight Carrier must communicate its growth plan, operational metrics, and risk mitigation clearly to attract subscription momentum.

India’s SME IPO segment has seen periodic surges when economic conditions and investor sentiment align. In-principle approvals from exchanges like BSE are essential first steps, but successful listings depend on follow-through: investor demand, listing logistics, and post-IPO performance. Logistics as a sector is viewed favorably given rising trade flows and infrastructure spending. However, past SME IPOs have sometimes struggled with liquidity post-listing. Keeping trading interest alive will require consistent performance and perhaps dividends or capital appreciation.

With the BSE SME approval in hand, Dhillon Freight Carrier needs to finalize its IPO opening and closing dates, allotment process, and ensure all regulatory and compliance documents are in place. Lead manager obligations include distributing the draft prospectus, collecting applications, and planning listing mechanics. The timeline may depend on market conditions: any macroeconomic jitters or slowdown could affect launch timing. Once the shares begin trading, the company must deliver operational updates to hold investor trust.

Dhillon Freight Carrier’s IPO is more than a financial event; it’s a litmus test for India’s smaller logistics firms seeking growth via public capital. The BSE SME approval marks success in regulatory navigation, but the real challenge lies ahead: meeting investor expectations, sustaining business performance, and unlocking value for shareholders. The logistics sector offers promise, yet it’s a demanding field. As this IPO unfolds, investors will watch whether Dhillon Freight Carrier can chart a successful path from SME newcomer to reliable market player.

#Dhillon Freight Carrier IPO, #BSE SME approval, #Fixed-price logistics IPO

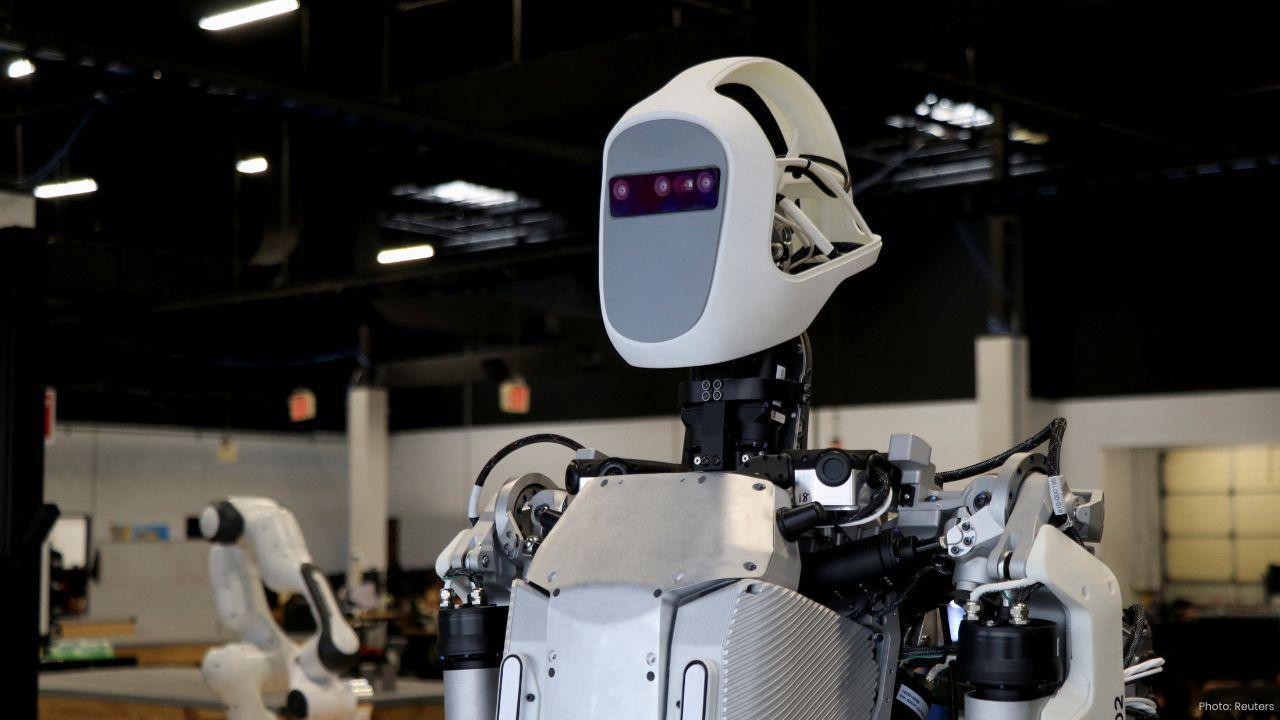

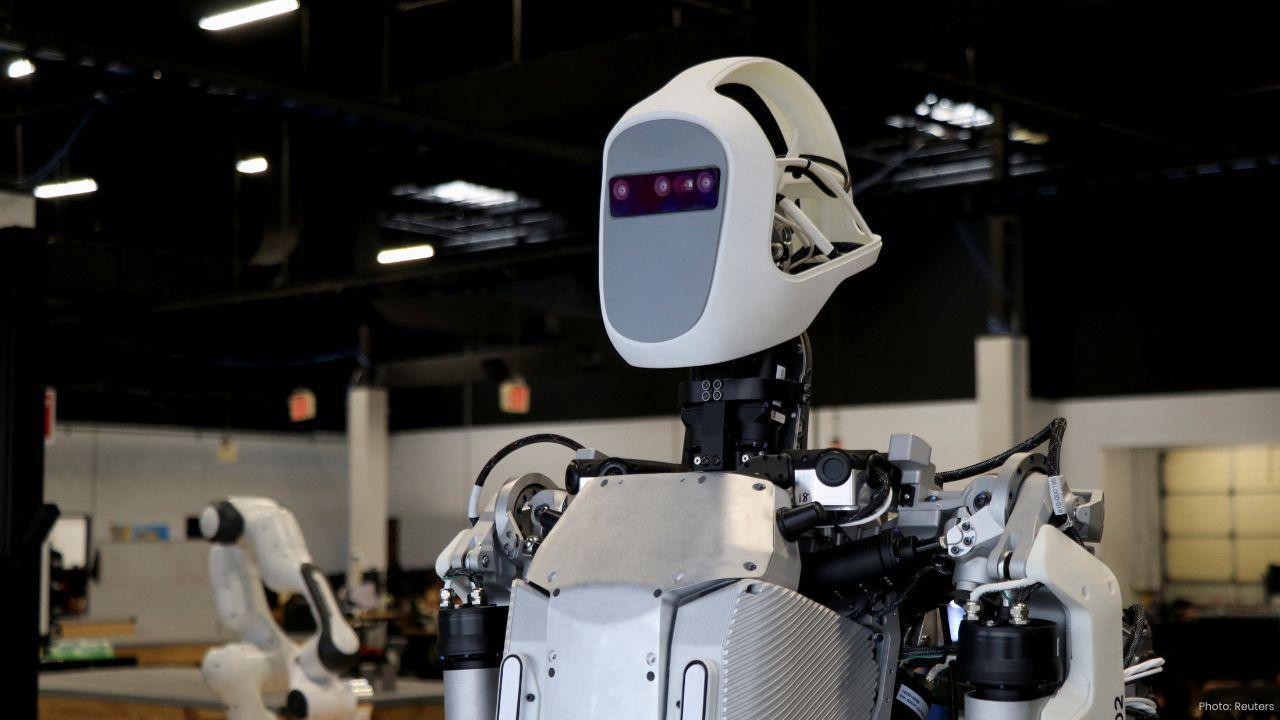

Unitree G1 Robot Shows Strong Agility and Recovery in Combat Test

Unitree’s G1 humanoid robot impresses with fast recovery, smooth movements, and strong agility durin

Autodesk Enhances Design & Production with AI-Powered Tools

Autodesk introduces advanced AI tools to streamline design and manufacturing, boosting efficiency an

2025 Mahindra Bolero Neo Facelift Spied With Fresh Grille Design

Spy photos reveal Mahindra’s forthcoming Bolero Neo facelift, showcasing a new front grille LED DRLs

Tata Technologies Acquires Germany’s ES-Tec Group for ₹750 Crore

Tata Technologies acquires Germany's ES-Tec Group for ₹750 crore to boost European operations and en

Harnessing Carbon Capture Balancing Industry and Climate Action

Carbon capture helps industries reduce emissions while growing, supporting sustainable development a

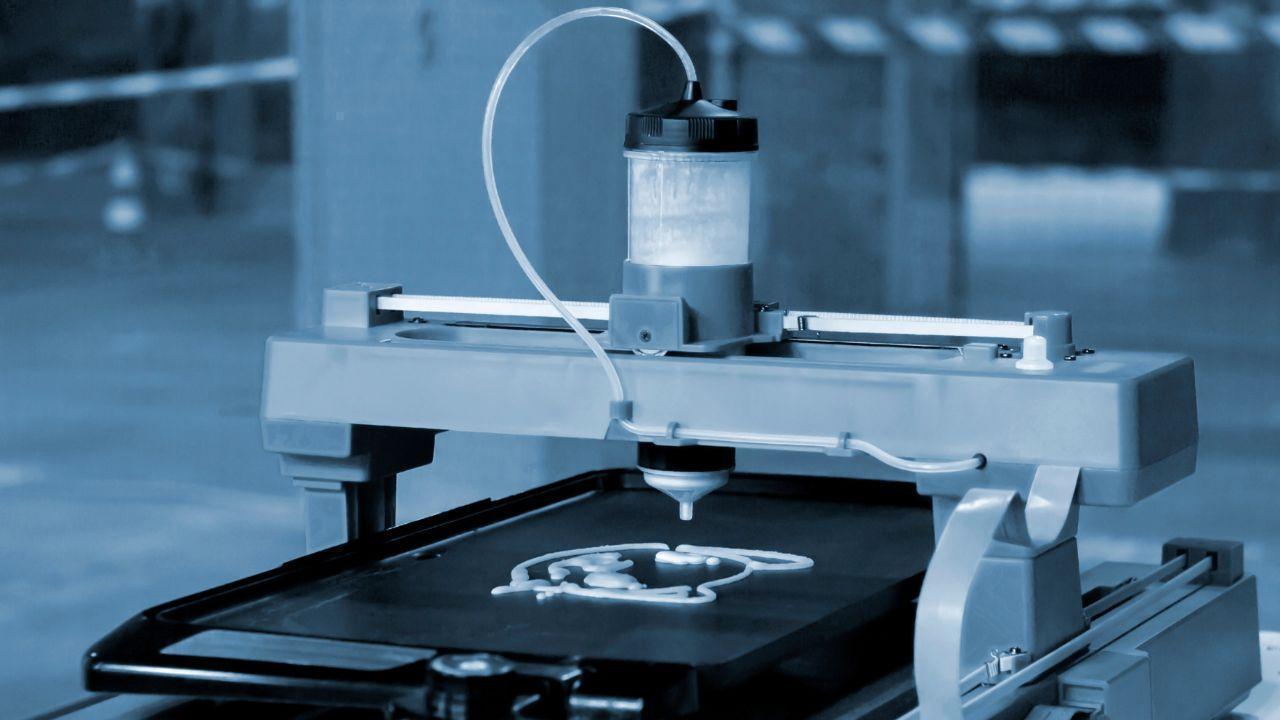

Meltio Opens First U.S. Metal 3D Printing Center in Danville

Meltio launches its first U.S. advanced metal 3D printing center in Danville, Virginia, featuring cu