Post by : Meena Rani

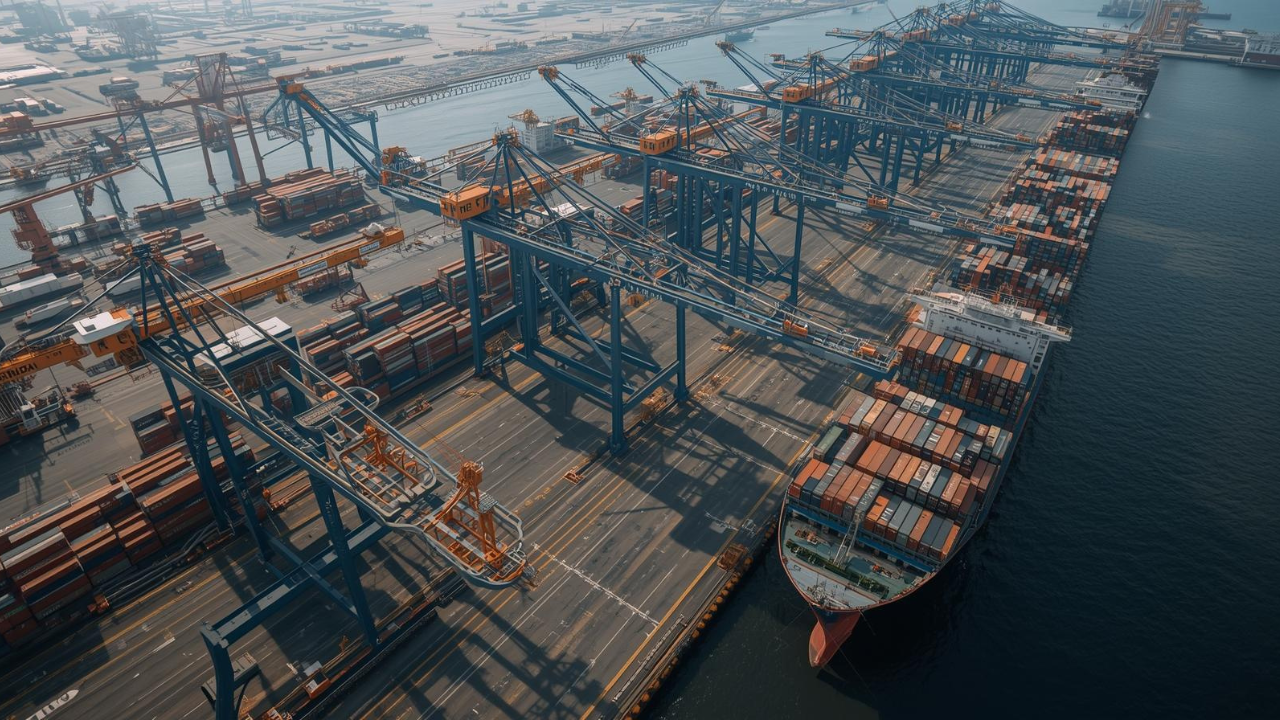

In the heart of the Arabian Gulf, two titans of trade—DP World and Abu Dhabi Ports—are locked in a fierce yet symbiotic rivalry that’s redefining global supply chains in 2025. As geopolitical tensions reroute shipping lanes and e-commerce surges, these UAE powerhouses are investing billions to secure their dominance, turning the Emirates into the world’s premier logistics crossroads.

This competition isn’t just about ports; it’s fueling innovation, sustainability, and resilience in an era of uncertainty.

As of mid-2025, DP World, the Dubai-based behemoth, has ramped up its global footprint with a staggering $2.5 billion capital expenditure plan, up from $2.2 billion in 2024. Key moves include terminal expansions in Canada, India, and Senegal, alongside upgrades at Jebel Ali Port, the UAE’s crown jewel handling 19.3 million TEUs annually.

Meanwhile, Abu Dhabi Ports (AD Ports Group) inked a 50-year deal in May 2025 for the East Port Said industrial zone in Egypt, bolstering its Suez Canal presence and challenging DP World’s grip on key trade routes.

In Africa, the rivalry intensifies. AD Ports is aggressively expanding with a $1 billion war chest, securing footholds in Angola, Sudan, and the Republic of Congo’s Pointe-Noire port. DP World counters with deepwater projects in the Democratic Republic of Congo’s Banana port, despite local disputes.

These moves align with global supply chain trends 2025, where diversification trumps single-source dependency. For businesses eyeing UAE logistics, such expansions mean faster rerouting amid Red Sea disruptions.

Industry leaders see this duel as a boon for efficiency. "The UAE’s dual-port strategy is turning potential rivalry into complementary strength—DP World excels in high-volume containers, while Abu Dhabi Ports dominates multipurpose and industrial zones," says Dr. Fatima Al-Mansoori, logistics analyst at the Dubai International Chamber.

Sultan Ahmed bin Sulayem, DP World’s Chairman, echoed this in a recent interview: "Our $2.5 billion push isn’t just growth; it’s about building resilient supply chains that withstand tariffs and conflicts."

On the AD Ports side, CEO Mohamed Juma Al Shamisi told AGBI, "We’re not competing—we’re co-creating a UAE ecosystem where smart ports like Khalifa integrate AI for predictive logistics."

The data paints a vivid picture of UAE’s logistics ascent. DP World reported record $20 billion revenue in 2024, with profits at $1.5 billion despite finance cost hikes, projecting 15% growth in 2025 TEU throughput.

Annual TEU Capacity: DP World 70M+, Abu Dhabi Ports 10M+, UAE Total 80M+

CapEx Investment: DP World $2.5B, Abu Dhabi Ports $1B+, UAE Total $3.5B+

Revenue Growth: DP World 12% YoY, Abu Dhabi Ports 15% YoY, UAE Avg 13.5%

Sustainability Targets: DP World 30% emission cut, Abu Dhabi Ports 25% renewable integration, UAE target net-zero by 2030

These figures highlight port automation as a game-changer, with UAE’s logistics market valued at $21.63 billion in 2025, eyeing a 6.9% CAGR to $30.19 billion by 2030.

The roots trace back to 2005, when DP World emerged from Dubai Ports Authority’s merger, swiftly acquiring UK ports amid controversy but cementing UAE’s trade prowess.

Abu Dhabi Ports, founded in 2006, focused on Khalifa Port’s 2012 launch, emphasizing industrial integration over sheer volume.

Several forces ignite this rivalry. Geopolitical flux—like Red Sea attacks diverting 12% of global trade—forces supply chain resilience.

Tech leaps, including AI and blockchain, demand agile infrastructure; UAE’s 5G rollout enables real-time tracking, reducing delays by 25%.

This UAE duo’s tussle ripples worldwide. Egypt’s ports, now UAE-dominated, streamline 10% of maritime trade via Suez.

In Africa, investments foster local jobs (e.g., 5,000 in Angola) while enhancing food security amid climate woes.

Looking to 2030, expect port automation and IoT to dominate, with 50 million connected devices slashing errors by 40%.

Sustainability will surge: DP World’s Masdar tie-up targets 30% emission cuts, while AD Ports pilots solar-powered zones.

This article is for informational purposes only and based on publicly available data as of November 3, 2025. Market figures may fluctuate; consult professionals for investment advice. Sources include AGBI, The National, and Maritime Executive.

In 2025, DP World and Abu Dhabi Ports aren’t just rivals—they’re architects of a more connected, resilient world. Businesses ignoring this UAE-led transformation risk being left at anchor.

#DPWorld #ADPorts #UAESupplyChain #PortLogistics #GlobalTrade #DubaiPorts #AbuDhabiPorts #MaritimeTrade #SupplyChain2025 #UAEPorts

Advances in Aerospace Technology and Commercial Aviation Recovery

Insights into breakthrough aerospace technologies and commercial aviation’s recovery amid 2025 chall

Defense Modernization and Strategic Spending Trends

Explore key trends in global defense modernization and strategic military spending shaping 2025 secu

Tens of Thousands Protest in Serbia on Anniversary of Deadly Roof Collapse

Tens of thousands in Novi Sad mark a year since a deadly station roof collapse that killed 16, prote

Canada PM Carney Apologizes to Trump Over Controversial Reagan Anti-Tariff Ad

Canadian PM Mark Carney apologized to President Trump over an Ontario anti-tariff ad quoting Reagan,

The ad that stirred a hornets nest, and made Canadian PM Carney say sorry to Trump

Canadian PM Mark Carney apologizes to US President Trump after a tariff-related ad causes diplomatic

Bengaluru-Mumbai Superfast Train Approved After 30-Year Wait

Railways approves new superfast train connecting Bengaluru and Mumbai, ending a 30-year demand, easi