Post by : Meena Rani

The global shipping industry is steering toward a cleaner horizon — and liquefied natural gas (LNG) is at the helm of this transformation. As maritime regulators tighten emission rules and the race for sustainable transport accelerates, LNG has emerged as the bridge fuel between heavy oil and zero-carbon energy.

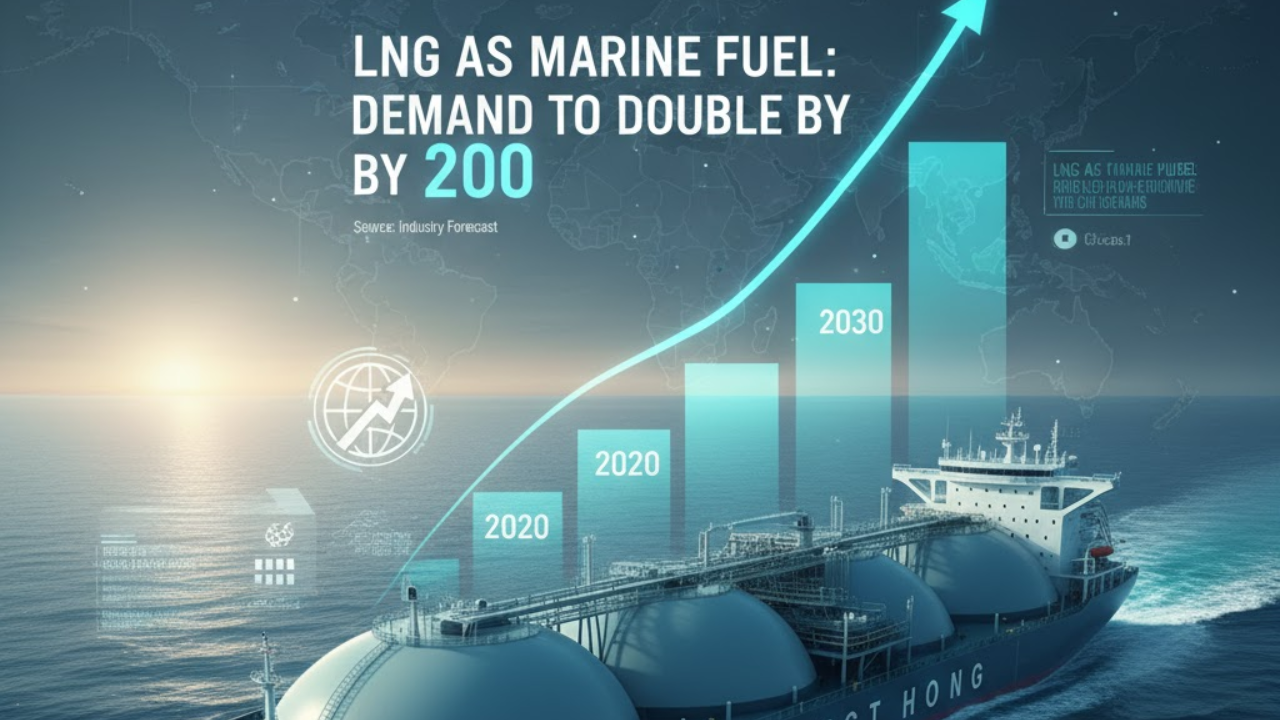

According to Reuters and DNV’s Maritime Forecast 2050, global demand for LNG as a marine fuel is expected to at least double by 2030, making it the fastest-growing segment in maritime energy.

But what’s driving this boom — and can LNG truly deliver on its “green” promise?

The maritime sector, which carries around 90% of global trade, is one of the largest energy consumers on the planet. Historically dependent on heavy fuel oil, it now faces mounting pressure from the International Maritime Organization (IMO) to cut greenhouse gas emissions by 50% before 2050.

To meet this goal, shipowners are turning to LNG (liquefied natural gas) — a fuel that burns cleaner than oil and meets IMO 2020 sulfur emission standards.

When compared to traditional marine fuels, LNG offers:

25% less CO₂ emissions

90% reduction in NOₓ (nitrogen oxides)

99% reduction in SOₓ (sulfur oxides)

Elimination of particulate matter

These benefits make LNG a powerful short- to mid-term solution for achieving compliance while reducing the environmental footprint of global shipping.

LNG is natural gas cooled to –162°C, turning it into a liquid that takes up only 1/600th of its original volume — making it ideal for storage and long-distance transport.

When used as marine fuel, LNG is burned in dual-fuel engines that can switch between LNG and conventional fuel depending on availability. This flexibility gives ship operators both energy security and cost stability, especially in volatile oil markets.

Modern vessels are being designed or retrofitted with LNG-ready engines, and ports around the world are investing in bunkering infrastructure to support large-scale adoption.

The adoption of LNG is no longer confined to early adopters — it’s going mainstream.

Europe has been at the forefront, with ports in Rotterdam, Hamburg, Marseille, and Barcelona expanding LNG bunkering capacity. The European Union’s Green Deal and Fit for 55 policy have further accelerated LNG investments to decarbonize maritime transport.

Asia is now leading in scale. China, South Korea, Japan, and Singapore are rapidly building LNG terminals and dual-fuel fleets. Singapore, in particular, has positioned itself as a global LNG bunkering hub, handling both container vessels and cruise liners.

In the United States, ports in Houston, Jacksonville, and Los Angeles are adding LNG fueling capabilities, while QatarEnergy — the world’s largest LNG exporter — is supplying new long-term marine fuel contracts to global operators.

Shipping giants like Maersk, CMA CGM, Shell, and MSC have either launched or ordered LNG-powered ships, betting on the fuel’s long-term potential to reduce emissions before zero-carbon options mature.

The growth in LNG-powered fleets is being matched by an infrastructure explosion.

According to SEA-LNG, over 250 LNG bunkering facilities are now operational or under construction worldwide — up from just 60 five years ago.

Major ports including Rotterdam, Antwerp, Singapore, Fujairah, and Yokohama are now equipped for ship-to-ship bunkering, enabling faster and safer fuel transfers.

This global network ensures that LNG is no longer a niche choice but a mainstream alternative, capable of powering international trade routes from Asia to Europe.

Beyond its environmental advantages, LNG offers strong financial and operational incentives.

Shipowners can benefit from lower fuel costs, especially when oil prices rise. LNG also extends engine life, reduces maintenance needs, and provides better combustion efficiency.

Additionally, the use of dual-fuel engines provides resilience in fluctuating energy markets — vessels can easily switch between fuels depending on cost and availability.

In regions like Europe and North America, operators using LNG may also receive tax credits, carbon incentives, or port fee reductions, as governments push for cleaner energy adoption.

Despite its advantages, LNG is not without controversy. Critics point to methane slip — the small amount of unburned methane released during combustion or leakage, which has a higher global warming potential than CO₂.

However, new technologies like next-generation low-pressure dual-fuel (LPDF) engines and methane capture systems are rapidly reducing emissions.

Companies like MAN Energy Solutions and Wärtsilä are developing engines with methane slip reductions of up to 90%, making LNG a cleaner and more credible transitional fuel until fully carbon-neutral options — such as ammonia, hydrogen, and synthetic fuels — become commercially viable.

The IMO’s decarbonization roadmap recognizes LNG as a “transition fuel”, not the final destination. Its adoption is helping the industry prepare for the next stage: bio-LNG and e-LNG — renewable versions of LNG produced from biogas or renewable electricity.

Bio-LNG can be blended with traditional LNG, allowing ships to reduce lifecycle emissions even further without modifying engines or infrastructure.

This hybrid approach will allow shipowners to meet future IMO targets while keeping existing LNG assets relevant beyond 2030.

According to Clarksons Research, over 1,000 LNG-powered vessels will be in operation by 2030 — up from just 350 in 2024. LNG bunkering demand is projected to rise from 13 million tons to over 25 million tons annually.

Meanwhile, the global LNG bunkering market is expected to surpass $25 billion by 2032, with Asia-Pacific leading the growth.

Trending high-volume keywords driving global searches include:

LNG marine fuel 2025, green shipping fuel, dual-fuel vessel technology, LNG bunkering infrastructure, IMO 2030 goals, maritime decarbonization, LNG demand forecast, sustainable ship propulsion.

LNG’s rise is not just about cleaner fuel — it’s about building the foundation for the next generation of maritime energy, where innovation and sustainability sail together.

This article is intended for informational and educational purposes only. It summarizes current trends, public reports, and projections on LNG adoption in the maritime industry. It should not be considered as financial, engineering, or policy advice.

LNG marine fuel, LNG demand 2030, maritime decarbonization, sustainable shipping fuel, dual-fuel engines, clean energy for ships, low-emission shipping, IMO net-zero goals, marine fuel transition, green shipping technology

Advances in Aerospace Technology and Commercial Aviation Recovery

Insights into breakthrough aerospace technologies and commercial aviation’s recovery amid 2025 chall

Defense Modernization and Strategic Spending Trends

Explore key trends in global defense modernization and strategic military spending shaping 2025 secu

Tens of Thousands Protest in Serbia on Anniversary of Deadly Roof Collapse

Tens of thousands in Novi Sad mark a year since a deadly station roof collapse that killed 16, prote

Canada PM Carney Apologizes to Trump Over Controversial Reagan Anti-Tariff Ad

Canadian PM Mark Carney apologized to President Trump over an Ontario anti-tariff ad quoting Reagan,

The ad that stirred a hornets nest, and made Canadian PM Carney say sorry to Trump

Canadian PM Mark Carney apologizes to US President Trump after a tariff-related ad causes diplomatic

Bengaluru-Mumbai Superfast Train Approved After 30-Year Wait

Railways approves new superfast train connecting Bengaluru and Mumbai, ending a 30-year demand, easi