Post by : Amit

U.S. Set to Ban Chinese Tech in Undersea Cables Over Security Concerns

In a decisive move that underscores the growing digital Cold War between Washington and Beijing, the U.S. government is preparing sweeping new regulations that would prohibit American companies from using Chinese technology in undersea internet cables. The ban, expected to be announced later this year by the Commerce Department, reflects intensifying U.S. efforts to protect vital global communication infrastructure from potential espionage and cyber sabotage by foreign adversaries—particularly China.

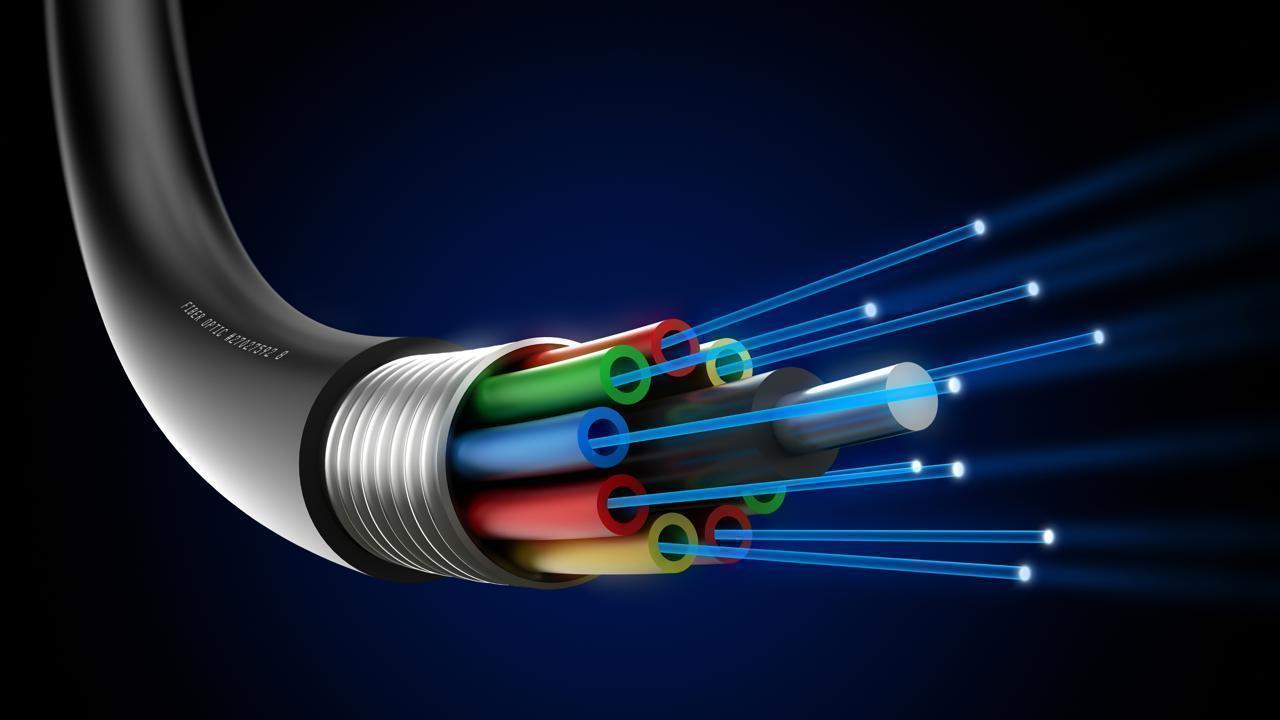

The cables in question lie at the very foundation of global internet infrastructure. Stretching over 1.4 million kilometers across the ocean floor, these fiber-optic lines carry more than 95% of the world’s internet traffic, including financial transactions, diplomatic communications, military orders, and personal messages. The stakes, in both economic and national security terms, could hardly be higher.

The proposed ban would target equipment and technology from Chinese manufacturers deemed high-risk, especially those with close ties to the Chinese Communist Party. Central to this crackdown is HMN Tech, a telecommunications company formerly owned by Huawei, which U.S. intelligence agencies have flagged for its potential role in enabling digital espionage on behalf of the Chinese state.

The Silent Backbone of the Internet—and a Strategic Vulnerability

Despite being invisible to the average user, undersea cables are essential to daily life in the digital age. A single cable can transmit tens of terabits of data per second, enabling the cloud services, video calls, banking systems, and logistics platforms we depend on every day.

Because of their strategic importance, these cables have increasingly become a flashpoint in geopolitical conflicts, especially as tensions rise between global superpowers. For the United States, the prospect of a foreign adversary gaining physical or digital access to these arteries poses a direct threat to national sovereignty and economic competitiveness.

"These cables are the nervous system of the internet,” says James Lewis, senior vice president at the Center for Strategic and International Studies. “If adversaries can manipulate, intercept, or degrade their function, they can disrupt economies and spy on everything from corporate secrets to state intelligence.”

China’s Growing Footprint in Global Telecom Infrastructure

Over the past decade, China has rapidly expanded its presence in global telecommunications infrastructure—both terrestrial and undersea. Through state-supported firms like Huawei, ZTE, and HMN Tech, Chinese companies have either laid or participated in the construction of dozens of international cables linking Asia, Africa, Europe, and the Americas.

While these projects are often marketed as cost-effective and high-performance, U.S. officials argue that their long-term implications are deeply troubling. The concern is not only about who builds the cables, but also who supplies the repeaters, switches, and software that govern data flow within them.

In particular, intelligence agencies warn that Chinese-made components could be equipped with backdoors or vulnerabilities that Beijing could exploit to intercept sensitive information or disable network traffic during a geopolitical crisis.

According to leaked documents and former security officials, China’s People’s Liberation Army has long prioritized cyber-infrastructure as a tool of hybrid warfare—making the dominance of Chinese tech in global cables an unacceptable risk for many U.S. policymakers.

HMN Tech: At the Center of the Storm

The latest U.S. move puts HMN Tech squarely in the crosshairs. Once a subsidiary of Huawei Marine Networks, HMN was sold to Shanghai-listed Hengtong Optic-Electric Co. in 2020 after Washington’s escalating sanctions on Huawei threatened its overseas operations. However, U.S. officials say the company remains closely aligned with Beijing’s strategic objectives.

HMN has been involved in at least a dozen major undersea cable projects in recent years, including links between Africa and Asia, and has submitted bids on future cables that would land in U.S.-allied territories.

Officials now fear that U.S. cloud providers, data centers, and telecom carriers might inadvertently use HMN-supplied components in domestic or international cables—creating unseen vulnerabilities in the heart of their networks.

The Commerce Department's proposed regulations are intended to eliminate this risk before it takes root.

National Security Meets Economic Prudence

The Biden administration’s move is the latest in a string of initiatives aimed at "de-risking" critical supply chains and communications systems. Earlier this year, the Federal Communications Commission (FCC) denied a license for a cable project involving Chinese participation, citing national security risks.

The upcoming Commerce Department rules are expected to go further, banning not just the use of Chinese suppliers in future projects but also limiting American firms' ability to source spare parts, upgrades, or even software patches from flagged vendors.

“This is not about punishing individual companies; it's about safeguarding infrastructure that is vital to national and global security,” a senior Commerce official stated on background.

Still, the decision is not without costs. Chinese firms like HMN Tech often offer lower-cost options compared to Western counterparts. That has made them especially attractive to cable consortia working in developing regions or on tight budgets. The U.S. ban could raise project costs or create delays, especially in hard-to-reach geographies.

Global Response and Ripple Effects

The implications of the U.S. move are expected to ripple far beyond its borders. Already, key allies such as the United Kingdom, Australia, and Japan have begun reevaluating their use of Chinese technology in telecom and cable infrastructure. The new U.S. rules could accelerate a global decoupling from Chinese suppliers in the undersea domain.

At the same time, some countries may resist the pressure, particularly in Southeast Asia, Africa, and Latin America—regions where Chinese investment in digital infrastructure has been substantial. In such areas, the affordability and availability of Chinese tech may outweigh the more abstract promise of cybersecurity.

Experts say the resulting divergence could lead to a bifurcation of the global internet, with one sphere dominated by U.S.-approved technologies and another by Chinese vendors—a digital iron curtain of sorts.

“The world could split into two parallel internets,” warns Dr. Laura DeNardis, a professor of internet governance at Georgetown University. “One aligned with Western norms of openness and security, and another built on state control and centralized access.”

Industry Stakeholders: Between a Rock and a Hard Place

For the private sector, the new U.S. policy poses both challenges and opportunities. Large cable operators, cloud service providers, and telecom giants must now vet their suppliers more rigorously and possibly re-engineer ongoing projects to comply with the new rules.

Many U.S. firms have already been moving away from Chinese components over the past five years. But smaller players may find the transition more burdensome, particularly if Western supply chains cannot scale quickly enough to meet demand.

Meanwhile, U.S.-based secure hardware vendors, such as SubCom and TE SubCom, are likely to benefit from increased demand for compliant systems. European firms like Alcatel Submarine Networks (ASN) may also see a boost, assuming they can reassure buyers about the provenance of their supply chains.

To support this shift, the Commerce Department is reportedly considering funding incentives, technology transfer agreements, and new export controls on sensitive cable-related technology.

China’s Response: Predictable But Defiant

While Beijing has not yet issued an official response to the proposed U.S. ban, past actions suggest a sharp rebuke is forthcoming. Chinese officials have repeatedly accused Washington of abusing national security as a pretext to suppress competition and maintain technological supremacy.

In previous statements, the Chinese Ministry of Foreign Affairs said that U.S. actions are “unfounded, discriminatory, and contrary to the principles of fair trade and cooperation.”

Some analysts warn that China could retaliate by increasing restrictions on U.S. tech firms operating in its domestic market or by accelerating its own parallel internet infrastructure projects, such as the Digital Silk Road.

Such tit-for-tat measures could deepen the fracture in global digital systems and further erode the possibility of international standards-based cooperation.

A Digital Frontline in a New Geopolitical Era

The move to ban Chinese technology from undersea cables is just the latest illustration of how digital infrastructure has become a frontline in geopolitical competition. As the line between cyberspace and national defense continues to blur, decisions once relegated to engineers and business executives are now being made in the Situation Room and on Capitol Hill.

The Biden administration has been clear: safeguarding the physical and logical backbone of the internet is a matter of national interest. But balancing security with innovation, global reach with sovereignty, and cost-efficiency with trust will remain an ongoing challenge.

In an age where data is the new oil—and cables are the pipelines—who lays those pipes, and who controls their flow, may define the next generation of global power.

The Battle Beneath the Waves

The U.S. effort to ban Chinese technology from undersea cables is more than a policy tweak—it’s a strategic maneuver in an escalating contest over the control of the digital world. As the physical infrastructure of the internet becomes a new theater for geopolitical rivalry, decisions made today will shape how information moves, how economies grow, and how democracies defend themselves in the decades to come.

What happens under the ocean may well determine who leads above it.

USA, China, Conflicts

Advances in Aerospace Technology and Commercial Aviation Recovery

Insights into breakthrough aerospace technologies and commercial aviation’s recovery amid 2025 chall

Defense Modernization and Strategic Spending Trends

Explore key trends in global defense modernization and strategic military spending shaping 2025 secu

Tens of Thousands Protest in Serbia on Anniversary of Deadly Roof Collapse

Tens of thousands in Novi Sad mark a year since a deadly station roof collapse that killed 16, prote

Canada PM Carney Apologizes to Trump Over Controversial Reagan Anti-Tariff Ad

Canadian PM Mark Carney apologized to President Trump over an Ontario anti-tariff ad quoting Reagan,

The ad that stirred a hornets nest, and made Canadian PM Carney say sorry to Trump

Canadian PM Mark Carney apologizes to US President Trump after a tariff-related ad causes diplomatic

Bengaluru-Mumbai Superfast Train Approved After 30-Year Wait

Railways approves new superfast train connecting Bengaluru and Mumbai, ending a 30-year demand, easi