Post by : Saif

Japan’s economic debate has entered a sensitive stage as a key coalition leader warned that politicians should not interfere with central bank decisions. The message comes at a time when the country faces rising living costs, a weak currency, and growing discussion about interest rate hikes and tax cuts.

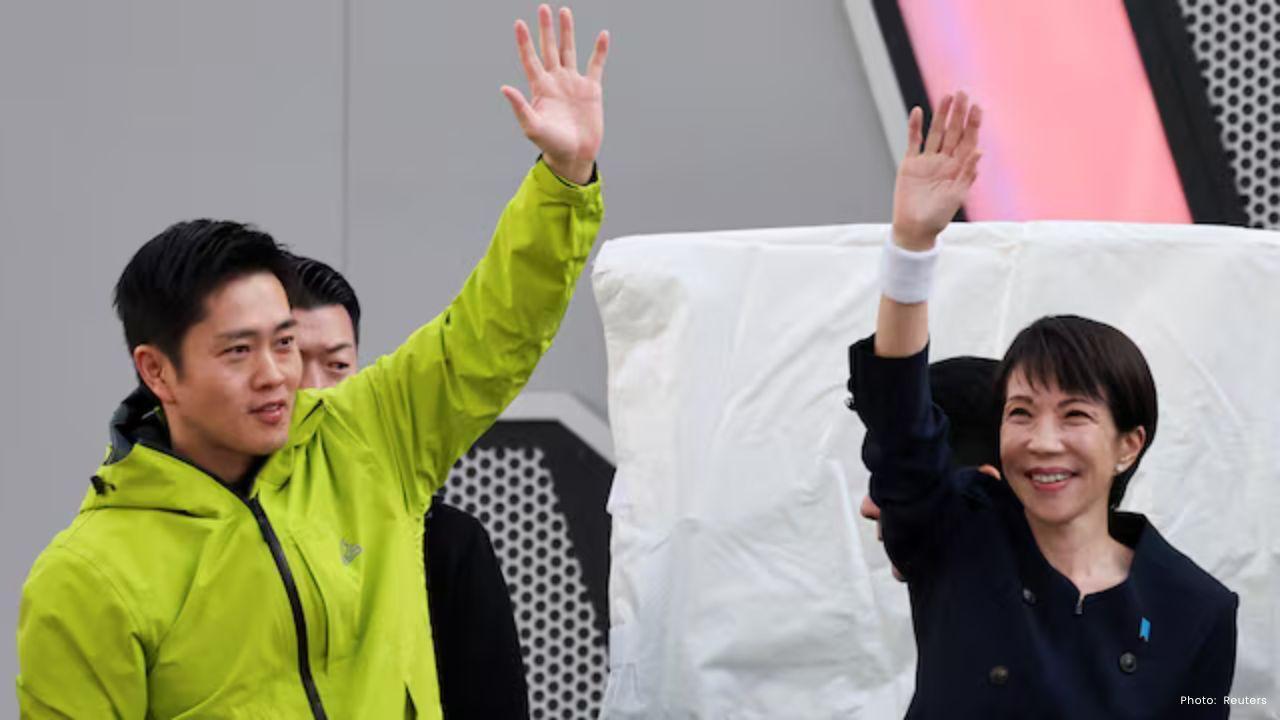

Hirofumi Yoshimura, head of the Japan Innovation Party, which is the junior partner in the ruling coalition, said clearly that interest rate decisions must remain in the hands of the central bank. He stressed that elected leaders should not try to guide or pressure the rate timing set by the Bank of Japan.

His statement is important because markets often worry when political leaders appear to influence central bank policy. Investors usually prefer central banks to act independently, based on data and financial conditions, not election promises.

Yoshimura explained that if rates rise further, there may be short-term pain for households and businesses. Mortgage payments could increase, and borrowing may become more expensive. Still, he said such decisions must be made by the central bank after studying inflation, currency movement, and market behavior — not by politicians seeking quick public approval.

Japan has been dealing with a weak yen for some time. A weaker currency helps exporters because their goods become cheaper overseas. But it also raises the price of imports, including food and energy. That pushes up daily living costs for families. Because of this mixed effect, currency weakness creates a policy dilemma.

Prime Minister Sanae Takaichi and her ruling party recently won a strong election victory. After the vote, she renewed a promise to suspend the sales tax on food for two years to help households manage rising prices. Food in Japan currently carries a lower consumption tax rate than most other goods, but removing it fully — even for a limited time — would create a large gap in government revenue.

Yoshimura said the food tax suspension should happen as early as possible. He suggested that funding could come from non-tax sources, including savings, spending cuts, and possibly income from Japan’s large foreign exchange reserves. Japan holds one of the biggest reserve pools in the world, built mainly to defend its currency during market stress.

Using reserves for domestic budget support is a serious and debated idea. Supporters say it avoids new government debt. Critics say reserves are meant mainly for currency stability and emergency intervention, not regular spending. If reserves are reduced too much, market confidence could weaken.

What makes this moment delicate is the balance between fiscal policy and monetary policy. Fiscal policy means government decisions on taxes and spending. Monetary policy means central bank control of interest rates and money supply. When both sides move in different directions, confusion can result. For example, if the government boosts spending while the central bank raises rates, the signals to markets can clash.

Yoshimura’s comments suggest the coalition wants to avoid that confusion. His position is that the government should use the budget and structural reforms to strengthen the economy, while the central bank handles interest rates and inflation control.

This separation is not just technical — it is about trust. Central bank independence is a core principle in many developed economies. When politicians interfere too much, markets may fear that rate decisions are being made for political gain instead of economic stability. That fear can lead to currency swings and bond market stress.

Japan has already seen how sensitive markets can be. In recent months, concerns about government finances and policy direction caused volatility in the yen and government bonds. Since then, leaders have been more careful with their signals.

From an editorial point of view, the warning against political meddling is timely and wise. Short-term political goals often focus on voter comfort before elections. Central banking, however, must focus on long-term stability. Inflation control, currency balance, and financial system health require decisions that are sometimes unpopular but necessary.

At the same time, the government’s plan to ease food tax pressure shows awareness of household strain. The challenge is funding that relief in a responsible way. Tax cuts without stable funding can weaken public finances and create future problems.

Japan now stands at a policy crossroads. Rate decisions, tax relief, currency stability, and fiscal discipline must be aligned carefully. Clear roles — politicians handling budgets and central bankers handling rates — will help reduce confusion and maintain confidence.

#trending #latest #armustnews #JapanEconomy #BankOfJapan #InterestRates #Yen #FiscalPolicy #MonetaryPolicy #TaxPolicy

Advances in Aerospace Technology and Commercial Aviation Recovery

Insights into breakthrough aerospace technologies and commercial aviation’s recovery amid 2025 chall

Defense Modernization and Strategic Spending Trends

Explore key trends in global defense modernization and strategic military spending shaping 2025 secu

Tens of Thousands Protest in Serbia on Anniversary of Deadly Roof Collapse

Tens of thousands in Novi Sad mark a year since a deadly station roof collapse that killed 16, prote

Canada PM Carney Apologizes to Trump Over Controversial Reagan Anti-Tariff Ad

Canadian PM Mark Carney apologized to President Trump over an Ontario anti-tariff ad quoting Reagan,

The ad that stirred a hornets nest, and made Canadian PM Carney say sorry to Trump

Canadian PM Mark Carney apologizes to US President Trump after a tariff-related ad causes diplomatic

Bengaluru-Mumbai Superfast Train Approved After 30-Year Wait

Railways approves new superfast train connecting Bengaluru and Mumbai, ending a 30-year demand, easi